Learning the QuickBooks keyboard shortcuts for some of your more common tasks will help improve efficiency, and maximize your QuickBooks ROI.

Here are some of our most-used QuickBooks desktop keyboard shortcuts!

August 13, 2018

Learning the QuickBooks keyboard shortcuts for some of your more common tasks will help improve efficiency, and maximize your QuickBooks ROI.

Here are some of our most-used QuickBooks desktop keyboard shortcuts!

If you’re preparing to switch systems, upgrade software, or clean up years of financial history, you may be facing one of the most crucial IT processes: data migration. For QuickBooks users, this often means replacing a company data file to fix performance issues, eliminate errors, or transition to a newer version of QuickBooks. Whether you’re…

February 24, 2025

In today’s fast-paced business world, maintaining accurate and up-to-date financial records is crucial for long-term success. Whether you’re a small business owner, a franchise operator, or managing a growing enterprise, bookkeeping updates should never be overlooked.

Outdated bookkeeping can lead to cash flow issues, tax penalties, and even legal troubles. On the other hand, businesses that prioritize bookkeeping services gain better financial clarity, improved decision-making, and streamlined operations.

In this article, we’ll explore the six key reasons why keeping your bookkeeping updated matters and how it can impact your business’s financial health.

Your financial reports provide a real-time snapshot of your business’s financial health. Outdated or inaccurate bookkeeping can lead to poor decision-making, impacting cash flow, profitability, and long-term growth.

According to a Small Business Administration (SBA) report, 82% of businesses fail due to cash flow mismanagement. Keeping your books updated ensures you always have a clear picture of your revenue, expenses, and profitability.

✅ Generate accurate profit and loss statements

✅ Track monthly revenue vs. expenses

✅ Identify profit margins and growth trends

✅ Make data-driven business decisions

Imagine running a plumbing business and not realizing that material costs have increased by 15% over the last six months. Without updated bookkeeping, you might continue to price services based on outdated costs, reducing profitability.

Tax compliance is a legal obligation for all businesses. Late or incorrect tax filings can lead to heavy penalties, audits, or legal consequences.

According to the IRS, 40% of small businesses incur an average of $845 per year in tax penalties due to incorrect filings.

✅ Keep track of tax-deductible expenses

✅ Ensure on-time tax filings

✅ Prevent penalties for late payments

✅ Prepare audit-proof financial records

If you’re a franchise owner running multiple locations, missing even a single tax deadline can lead to compounded penalties. With regular bookkeeping updates, your accountant can file returns accurately and on time.

Many businesses struggle with cash flow problems due to untracked receivables and unexpected expenses. Without accurate bookkeeping, you risk running out of cash when you need it the most.

A study by U.S. Bank found that 82% of small business failures are due to poor cash flow management.

✅ Track accounts receivable and payable

✅ Identify slow-paying customers

✅ Forecast seasonal fluctuations

✅ Avoid late fees and overdraft charges

A home services business (e.g., HVAC repair) might experience seasonal revenue fluctuations. Without updated bookkeeping, the owner might overspend in peak months and struggle to cover payroll during slower months.

Without accurate financial records, planning for growth becomes challenging. Whether you’re seeking a business loan, expanding locations, or hiring staff, lenders and investors need up-to-date financials before approving funding.

According to a study by Nav, 82% of small businesses that applied for loans were denied due to poor financial documentation.

✅ Ensure clean financial records for loan approvals

✅ Identify profitable service lines

✅ Forecast business expansion opportunities

✅ Secure better investor confidence

A growing bookkeeping franchise looking to open a new location must present accurate financial records to secure a business loan. Without updated books, securing funding becomes nearly impossible.

Fraud and accounting errors can drain business profits without immediate detection. Regular bookkeeping updates help identify suspicious transactions and prevent financial mismanagement.

The Association of Certified Fraud Examiners (ACFE) reports that businesses lose 5% of annual revenue due to fraud, with small businesses being the most vulnerable.

✅ Detect unauthorized transactions

✅ Identify accounting errors before they escalate

✅ Reduce theft and mismanagement risks

✅ Ensure reconciled bank statements

A landscaping business with multiple employees might find discrepancies in vendor payments. Regular bookkeeping audits can flag duplicated or fraudulent invoices before they cause significant losses.

Bookkeeping is time-consuming, especially for business owners managing operations, sales, and customer service. Outsourcing bookkeeping services or keeping records updated saves hours of manual work and reduces financial stress.

A study by Clutch found that 45% of small business owners spend more than 80 hours per year on bookkeeping and taxes.

✅ Free up valuable time for business operations

✅ Avoid last-minute tax season stress

✅ Reduce manual data entry errors

✅ Improve overall work-life balance

A roofing contractor handling both client projects and bookkeeping may struggle to keep up with financial records. Outsourcing bookkeeping saves time and allows them to focus on growing their business.

It’s recommended to update your bookkeeping weekly or monthly to ensure accurate financial tracking.

While small businesses can use software like QuickBooks or Xero, outsourcing bookkeeping services ensures accuracy and compliance.

The cost varies based on business size and complexity. Outsourced bookkeeping services range from $300 to $2,500 per month.

You risk tax penalties, cash flow issues, inaccurate financial reporting, and potential fraud.

Popular options include QuickBooks, Xero, FreshBooks, and Wave Accounting.

Regular bookkeeping updates are essential for financial accuracy, tax compliance, cash flow management, and fraud prevention. By prioritizing bookkeeping services, businesses can make informed decisions, secure funding, and scale successfully.

If you’re struggling to maintain accurate financial records, consider partnering with a professional bookkeeping service to ensure long-term financial stability and growth.

Consider hiring a fractional Controller to streamline your finances without the cost of a full-time hire.

March 26, 2025

Whether you’re running a landscaping company, plumbing service, HVAC business, or any other type of home service operation, bookkeeping is one of the most essential—and often underestimated—components of success. While marketing, client satisfaction, and operations are always top of mind, without strong financial practices in place, your business may struggle to grow or stay profitable.

This article explores the top bookkeeping benefits for home service business owners and why it should be a central part of your operations. Whether you’re an entrepreneur just starting out or a seasoned small business owner, understanding how bookkeeping supports your business’s health can save time, reduce stress, and even increase profits.

Bookkeeping is the process of recording and organizing your business’s financial transactions, including income, expenses, payroll, inventory, and more. In home service businesses, this could include:

Customer payments for services

Vendor invoices for materials or equipment

Employee or contractor wages

Fuel, vehicle maintenance, and travel expenses

Software subscriptions or advertising spend

Accurate bookkeeping ensures that your financial records are current, reliable, and ready for tax time—or for making smart business decisions.

According to the U.S. Bureau of Labor Statistics, approximately 20% of small businesses fail within their first year, and 50% fail within five years. Poor financial management is one of the most common causes. Bookkeeping provides the foundation for sound financial management.

Cash flow is the lifeblood of any service business. Whether you’re waiting on customer payments or covering payroll, poor cash flow can derail even a profitable company.

With good bookkeeping practices in place:

You can track outstanding invoices and follow up with late payers.

You’ll know exactly how much money is coming in and going out each week.

You can forecast upcoming expenses and prevent cash shortages.

Example: A lawn care company might bill clients monthly but still need to pay employees weekly. With organized books, the owner can spot when they’ll fall short and take action—such as offering early-payment discounts to clients.

Tax season can be overwhelming, especially if your records are scattered across receipts, spreadsheets, and email chains. Bookkeeping consolidates everything in one place, making tax preparation straightforward.

Benefits include:

Accurate expense categorization to ensure you’re claiming all deductions

Real-time profit/loss reports to estimate tax liability

Easy collaboration with your CPA or tax preparer

According to the IRS, small business owners who keep organized records are less likely to face audits or penalties. Bookkeeping helps reduce errors, lower your tax bill, and avoid compliance issues.

Without good data, business decisions become guesses. Bookkeeping provides the financial insights you need to:

Set pricing based on actual costs

Hire new team members at the right time

Invest in new tools or marketing strategies

Cut wasteful spending

Example: A handyman service reviews their books and finds that advertising on one local platform has a much better ROI than another. By reallocating spend, they increase leads without spending more money.

Having up-to-date financial records makes you look more credible to banks, investors, and even clients. When applying for a loan or line of credit, you’ll often need:

Profit and loss statements

Balance sheets

Cash flow statements

All of which are made possible through regular bookkeeping.

Additionally, clients who see you operate with professionalism are more likely to trust your services and recommend your business.

Many home service businesses rely on a mix of full-time employees and independent contractors. Bookkeeping helps you:

Track hours and payments accurately

Generate paystubs or 1099s for contractors

Stay compliant with labor and tax regulations

Example: A cleaning service that pays multiple part-time workers benefits from a clear system that tracks wages, taxes withheld, and reimbursement for supplies or mileage.

From lawnmowers and vans to HVAC tools and plumbing supplies, home service businesses often have significant equipment costs. Bookkeeping helps you:

Depreciate assets correctly over time

Track maintenance expenses

Plan for future replacements

Tip: Using bookkeeping software like QuickBooks can automatically track and categorize these expenses, offering visibility into where your money goes.

If you ever face an audit, dispute, or legal review, your books are your first line of defense. Having accurate records protects you in situations involving:

Tax audits

Employment disputes

Vendor disagreements

Licensing reviews

Being able to quickly produce financial documentation shows that your business is legitimate and transparent.

Home service businesses often begin as solo operations but grow to include multiple employees, service areas, or even franchise opportunities. Good bookkeeping ensures you’re ready to scale by:

Highlighting your most profitable services

Tracking margins across different job types

Preparing accurate financial projections

Example: A pressure washing business wants to expand into a new neighborhood. Bookkeeping reports show which zip codes generate the most profit, guiding their marketing strategy.

At Out of the Box Technology, we recommend QuickBooks as the best-in-class solution for small and home-based service businesses.

It supports double-entry accounting (for more accurate records)

It integrates with tools like CRM systems, payment processors, and time tracking apps

It offers mobile access, perfect for business owners who are always on the go

It provides automated reporting, so you can view your profit & loss anytime

With QuickBooks, tasks like invoice tracking, payroll, mileage logging, and vendor payments become simple. Our team helps business owners with setup, customization, training, and support.

Meet Susan, who runs a mobile pet grooming business. At first, she tracked income using her PayPal account and stored receipts in a shoebox. By the time tax season rolled around, she had no idea what she owed or what she could deduct.

After partnering with Out of the Box Technology, she started using QuickBooks and set up a bookkeeping system tailored to her business. Within six months:

She had clear visibility into her cash flow

Her CPA was able to reduce her tax bill by $3,000

She confidently applied for a small business loan to buy a second van

Ideally, you should update your books weekly or at minimum, monthly. This ensures your records are current and helps avoid surprise issues at tax time.

Many business owners start by doing their own bookkeeping using tools like QuickBooks. As your business grows, it’s often more efficient and cost-effective to hire a bookkeeping service to ensure accuracy and free up your time.

Bookkeeping involves the day-to-day recording of transactions, while accounting focuses on analyzing and interpreting that data to support decisions, planning, and tax strategy.

Yes. Even if you’re the only person in your business, keeping accurate records protects you from tax issues, helps you understand your business performance, and supports growth.

We highly recommend QuickBooks, which offers both simplicity for beginners and robust features for growing businesses. Out of the Box Technology provides full QuickBooks support and integration.

For small business owners and home service entrepreneurs, bookkeeping is more than a back-office task—it’s a strategic asset. From improving cash flow and tax readiness to helping you grow and scale, the benefits are tangible and long-lasting.

Don’t let financial disorganization hold your business back. With the right tools and support, you can turn your numbers into powerful insights that guide better decisions.

At Out of the Box Technology, we help home service businesses implement bookkeeping systems that work. Whether you need help setting up QuickBooks, need monthly support, or are ready to outsource your entire bookkeeping function, we’re here to help.

Ready to take control of your books and boost your business?

Visit www.outoftheboxtechnology.com to learn more about our bookkeeping solutions for home service businesses.

March 14, 2025

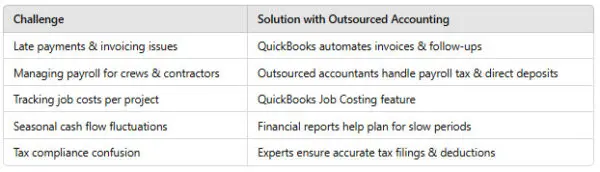

Running a home services business—whether it’s landscaping, plumbing, HVAC, roofing, or cleaning services—comes with many moving parts. From managing clients and scheduling jobs to handling employees and equipment, keeping up with financial tasks like bookkeeping and accounting can quickly become overwhelming.

That’s where outsourced accounting comes in. Instead of managing your books in-house or struggling to keep up with QuickBooks on your own, outsourcing your accounting can provide cost savings, expert financial guidance, and greater efficiency—all while letting you focus on growing your business.

In this article, we’ll explore:

Outsourced accounting is when a business hires a third-party accounting firm to handle financial tasks such as:

For home services business owners, outsourcing accounting means less time spent on financial paperwork and more time focusing on running your business efficiently.

Home service providers are always on the go—managing job sites, scheduling crews, and working directly with clients. Outsourcing accounting eliminates the burden of bookkeeping, payroll, and financial reporting, freeing up time to focus on growing your business.

Example: Instead of spending hours reconciling bank statements and chasing late invoices, a landscaping company owner can focus on winning new contracts and improving service quality.

Hiring an in-house accountant can be expensive—salary, benefits, and training all add up. With outsourced accounting, you pay only for the services you need, saving money while ensuring accurate financial management.

Example: A plumbing business that outsources accounting saves over $40,000 per year, money that can be reinvested into tools, marketing, or additional staff.

Many home services businesses struggle with cash flow, especially when dealing with seasonal fluctuations or late customer payments. Outsourced accounting helps:

Example: A roofing contractor who struggles with delayed client payments uses QuickBooks through an outsourced accountant to automate invoicing and send payment reminders, improving cash flow.

Tax laws are complex, and home services businesses must comply with sales tax, payroll tax, and income tax regulations. Outsourced accountants stay up to date with tax laws, ensuring accurate filings and helping you maximize deductions (without mistakes that could trigger an audit).

Example: An HVAC company using QuickBooks with an outsourced accountant saves thousands of dollars by properly classifying business expenses for tax deductions.

Outsourced accountants provide detailed financial reports, including:

With QuickBooks, these reports are generated in real-time, helping home services business owners make smarter decisions about pricing, expenses, and hiring.

Example: A cleaning service owner uses monthly QuickBooks reports to identify peak revenue months and adjust marketing spend accordingly.

When working with an outsourced bookkeeping service, using the right accounting software is crucial. QuickBooks is the gold standard for home services businesses because it offers:

Example: A lawn care business owner uses QuickBooks to track seasonal income, ensuring they budget properly for slower winter months.

For businesses that need fully managed accounting support, Outsourced Bookkeeping and Accounting Services can handle QuickBooks setup, payroll, invoicing, and more.

Costs vary based on the level of service needed, but most home services businesses pay between $5,000 – $20,000 per year, which is far less than hiring a full-time accountant.

Yes. You still make all financial decisions—an outsourced accountant simply manages the numbers and provides insights to help you make informed choices.

Yes. Job costing is essential for home service businesses. Your accountant will set up QuickBooks Job Costing to track profitability per project.

Absolutely. QuickBooks offers invoicing, payroll, expense tracking, job costing, and mobile access, making it the best choice for home service professionals.

You can start by contacting Out of the Box Technology for a customized bookkeeping solution that fits your home services business.

For home services business owners, outsourced accounting provides time savings, cost efficiency, expert financial management, and peace of mind. Whether you’re running a plumbing, HVAC, roofing, landscaping, or cleaning business, partnering with an outsourced accountant using QuickBooks will help you:

If you’re ready to streamline your bookkeeping and accounting with QuickBooks and expert support, explore Outsourced Bookkeeping and Accounting Services and take the next step toward financial success.

Contact us today to get started!

For self-employed individuals, freelancers, gig workers, and small business owners, paying taxes isn’t just a once-a-year event. If you expect to owe $1,000 or more in federal taxes, the IRS likely expects you to pay estimated tax payments each quarter — and the Q2 estimated tax deadline is June 15. In this guide, we’ll explain…

If your business is considering a move from Oracle NetSuite to QuickBooks, you’re not alone. While NetSuite is a powerful ERP platform, many growing businesses eventually find that it may be more complex—and costly—than they need. Whether you’re downsizing, simplifying your accounting systems, or seeking a more cost-effective solution, a NetSuite migration to QuickBooks can…

Selling a business can be one of the most profitable — and complex — decisions a small business owner makes. But before you celebrate a big payday, it’s essential to understand the tax implications of selling a business. From capital gains taxes to depreciation recapture and how goodwill is treated, the way your sale is…

For many growing businesses, Microsoft Dynamics (including Dynamics GP, NAV, or Business Central) offers robust ERP features. But as your organization evolves, you may find that the platform becomes too complex or costly for your current needs. That’s when a Microsoft Dynamics migration to QuickBooks becomes an attractive option. In this guide, we’ll explore when…