Running a small business requires not only hard work and daily oversight but also a well-thought-out plan that drives growth, aligns resources, and prepares for market changes. Annual planning is the tool that lets small business owners strategically map out objectives, budgets, and growth targets for the upcoming year. This guide will provide a comprehensive, step-by-step approach to developing an effective annual plan, complete with actionable tips, relevant data points, and real-world examples.

1. Understand the Importance of Annual Planning

Annual planning is the process of setting out a strategy and actionable roadmap that aligns with your business’s long-term goals. For small businesses, annual planning can mean the difference between steady growth and stagnant performance. Research shows that companies with a written plan grow 30% faster than those without (Small Business Administration).

Key Benefits of Annual Planning

- Goal Alignment: Aligning team efforts toward well-defined goals.

- Resource Allocation: Optimizing budgets, inventory, and workforce based on anticipated needs.

- Market Preparedness: Understanding industry trends and adjusting strategies to stay competitive.

2. Review the Past Year’s Performance

Start your annual planning with an objective review of the previous year. This helps identify what worked, what didn’t, and why.

Steps for Reviewing Performance

- Analyze Financials: Look at revenue, profit margins, expenses, and other key metrics.

- Examine KPIs: Key performance indicators (KPIs) provide insights into areas like customer retention, average transaction value, and cost per lead.

- Employee Performance: Understand staffing efficiency, productivity, and turnover rates.

Example: If your company saw a 15% drop in sales in the third quarter, was it seasonal, or was there a change in customer demand?

3. Set Specific, Measurable Goals

Effective annual planning requires setting SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound). Research shows that 70% of businesses that set goals perform better than those that don’t (Harvard Business Review).

Types of Goals to Consider

- Revenue Growth: Setting a percentage increase for total revenue.

- Customer Acquisition: Increasing the number of new customers by a specific rate.

- Product Launches: If launching new products or services, outline expected sales and growth metrics.

Example: Set a goal to increase your revenue by 12% by expanding your product line into a complementary area of interest to your customer base.

4. Build a Realistic Budget

A clear, well-researched budget is central to any effective annual plan. It should allocate funds across departments and initiatives, considering both past spending and projected needs. For small businesses, an optimized budget can prevent overextending resources and support sustainable growth.

Budget Categories to Focus On

- Operations: Include rent, utilities, and other necessary costs.

- Marketing: Allocate funds to support customer acquisition and brand awareness.

- Payroll: Ensure a realistic budget for staffing based on your projected needs.

Budgeting Tips

- Start with Essentials: Prioritize fixed expenses and necessary operating costs.

- Set Aside for Emergencies: Set aside around 5-10% for unforeseen expenses.

Example: If you spent 15% more than expected on marketing last year, investigate why and adjust this year’s budget accordingly.

5. Conduct a SWOT Analysis

SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats) allows small businesses to strategically identify internal and external factors that could impact growth.

Steps for Conducting a SWOT Analysis

- Identify Strengths: What does your business do well?

- Evaluate Weaknesses: Where do you see gaps or inefficiencies?

- Spot Opportunities: What trends or new markets could you tap into?

- Assess Threats: Are there external factors like competitors or market shifts?

Example: A small bakery may identify online sales as an opportunity, while rising ingredient costs may pose a threat.

6. Plan for Cash Flow Management

Poor cash flow is one of the leading reasons small businesses struggle. In fact, 82% of small business failures are due to cash flow problems (Fundera).

Strategies for Cash Flow Management

- Create a Cash Flow Forecast: Estimate cash inflows and outflows based on historical data.

- Optimize Payment Terms: Negotiate better terms with suppliers and offer incentives for early customer payments.

- Build a Cash Reserve: Aim to have at least three to six months’ worth of expenses saved.

Example: A consulting firm might implement a retainer fee model to ensure steady cash flow.

7. Establish Marketing and Sales Strategies

Define clear marketing and sales plans that align with your growth goals and budget. A comprehensive strategy can include both online and offline channels and should be adaptable based on market trends and data.

Key Marketing Channels to Consider

- Digital Marketing: SEO, social media, email marketing, and online ads.

- Customer Referrals: Build loyalty and encourage satisfied customers to refer your business.

- Content Marketing: Educate potential customers and establish your expertise.

Setting Sales Targets

Align sales targets with your broader business goals. This may include expanding into new markets, upselling existing customers, or introducing new services.

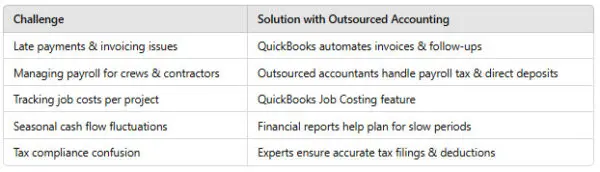

8. Invest in Technology and Tools

Utilizing technology helps streamline operations, improve customer service, and manage data. For example, 88% of small businesses believe that technology has helped them remain competitive (Deloitte).

Technology Investments for Small Businesses

- Accounting Software: For accurate bookkeeping and financial planning, consider QuickBooks, which can integrate with various banking and tax systems.

- Customer Relationship Management (CRM): Manage customer data and streamline sales processes.

- Inventory Management Tools: For businesses with physical products, inventory software helps avoid stockouts and over-purchasing.

9. Set a Timeline for Milestones

Break down your annual plan into quarterly or monthly milestones. This allows you to review and adjust strategies regularly, ensuring you stay on track toward achieving your goals.

Examples of Milestones

- Q1: Finalize new product designs and marketing materials.

- Q2: Launch a customer retention program.

- Q3: Evaluate mid-year budget and adjust based on performance.

- Q4: Begin year-end tax preparations and finalize annual report.

Example: A software development company may set a milestone for releasing beta features by Q2 to gather customer feedback.

10. Implement and Monitor Your Plan

Execution is key, but so is regularly monitoring progress. Schedule check-ins to review performance and adjust as needed. Utilize dashboards and reports to monitor KPIs in real-time.

Tips for Effective Monitoring

- Regular Team Meetings: Weekly or monthly meetings can keep everyone updated on progress and obstacles.

- Use KPI Dashboards: Track critical KPIs and make adjustments in real-time.

- Encourage Flexibility: If a particular goal or strategy isn’t working, be prepared to pivot.

11. Prepare for Tax Season and Compliance

Annual planning should also include preparations for tax season and compliance. Ensuring proper records and understanding tax deductions can help reduce liabilities.

Tax and Compliance Checklist

- Stay Organized: Keep receipts, invoices, and payroll records up-to-date.

- Work with a Tax Professional: Consult with experts who understand small business deductions and compliance.

- Set Aside Tax Payments: Plan quarterly tax payments to avoid large year-end liabilities.

Example: If you’ve purchased new equipment this year, remember to take advantage of any available tax deductions.

12. Review and Reflect

At the end of the year, review your annual plan to assess achievements and identify areas of improvement. This step closes the loop, helping you continuously improve your annual planning process.

Questions to Consider in Your Review

- What were our biggest successes?

- Where did we fall short?

- What can we learn from this year to improve next year’s plan?

Conclusion

Effective annual planning is about setting clear objectives, creating a roadmap to achieve those objectives, and having the flexibility to adapt as needed. Small businesses that prioritize planning not only perform better financially but also build resilience to navigate challenges. By taking the time to conduct a thorough annual planning session, your business will be better equipped for sustainable growth and success.

Meet with a QuickBooks Service Expert Today!

Prepare your business for 2025 with expert QuickBooks support! Our team offers tailored integrations and reliable solutions to streamline and optimize your bookkeeping processes. Connect with a QuickBooks expert today to set your business up for success.