Understanding the Differences Between a Controller and a Comptroller

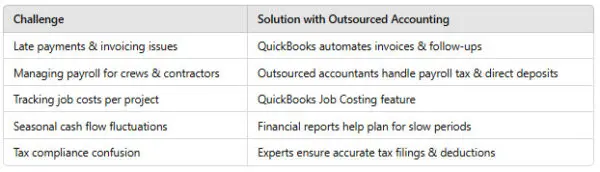

When running a home service business—whether it’s plumbing, HVAC, roofing, or landscaping—financial management plays a crucial role in your success. As your business grows, you may need to hire a financial professional to oversee your finances and ensure financial stability. But should you hire a Controller or a Comptroller?

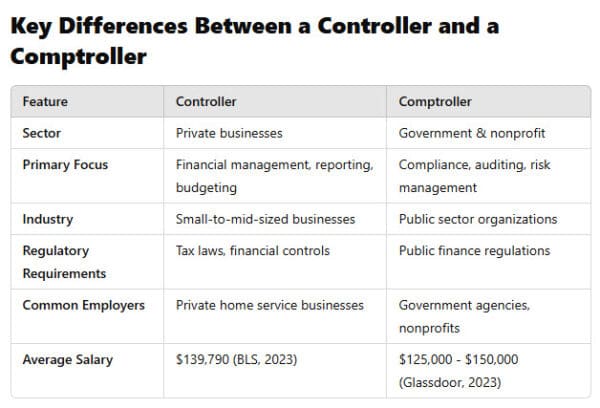

Although these titles sound similar, they have distinct roles and responsibilities. In this article, we’ll break down the key differences between a Controller and a Comptroller, their responsibilities, salaries, and how to determine which one is right for your home service business.

What Is a Controller?

A Controller is a senior-level executive responsible for managing a company’s financial records, reporting, and internal controls. This role is primarily found in private sector businesses, including small-to-mid-sized companies in the home service industry.

Key Responsibilities of a Controller

- Financial reporting: Prepares financial statements such as balance sheets, income statements, and cash flow statements.

- Budgeting and forecasting: Creates and monitors budgets to ensure financial stability.

- Internal controls: Implements financial controls to prevent fraud and ensure compliance.

- Tax compliance: Ensures the business meets tax obligations and works with accountants.

- Payroll oversight: Manages payroll processing and employee compensation.

- Cash flow management: Monitors and optimizes cash flow for operational efficiency.

- Technology and systems management: Oversees accounting software and financial reporting tools.

Who Needs a Controller?

Home service business owners who are experiencing growth may need a Controller if they:

✅ Have annual revenues exceeding $5 million

✅ Need better financial oversight beyond basic bookkeeping

✅ Require budget forecasting and long-term planning

✅ Want to ensure compliance with tax laws and regulations

According to the U.S. Bureau of Labor Statistics (BLS), the median annual salary for financial managers, which includes Controllers, is $139,790 per year (2023). However, small businesses may hire part-time or fractional Controllers to save costs.

What Is a Comptroller?

A Comptroller is a senior financial executive responsible for overseeing financial operations in government agencies, nonprofit organizations, and some large corporations. Unlike Controllers, Comptrollers typically work in the public sector and focus on compliance, auditing, and financial accountability.

Key Responsibilities of a Comptroller

- Financial oversight for public funds: Ensures proper use of government or nonprofit funds.

- Compliance and auditing: Manages internal audits to ensure compliance with financial regulations.

- Budget approval: Oversees budget allocations for government or nonprofit entities.

- Public financial reporting: Prepares financial statements that comply with public sector regulations.

- Risk management: Identifies and mitigates financial risks in government or nonprofit sectors.

Who Needs a Comptroller?

A Comptroller is typically not needed for private businesses like home service companies. However, home service businesses that work directly with government contracts or operate in heavily regulated industries may interact with a Comptroller at the state or local level.

According to Glassdoor, the average salary for a Comptroller in the U.S. is $125,000 to $150,000 per year, depending on location and organization size.

Which One Does Your Home Service Business Need?

For home service business owners, a Controller is the ideal choice for financial oversight. Here’s why:

✅ Better cash flow management: A Controller ensures your business has the necessary funds to cover expenses.

✅ Improved financial planning: They help you create long-term financial strategies and plan for expansion.

✅ Tax compliance & reporting: Controllers manage tax filings and ensure compliance with tax laws.

✅ Fraud prevention: They implement financial controls to protect against theft or fraud.

When Should You Hire a Controller?

A home service business should consider hiring a Controller when:

- Revenue exceeds $5 million annually

- The business has complex financial needs (e.g., multiple locations, various revenue streams)

- There is a need for in-depth financial forecasting and cost-cutting strategies

- The business is preparing for a sale, merger, or acquisition

FAQs

1. Can a small home service business afford a Controller?

Yes! Many businesses hire part-time, fractional, or outsourced Controllers to handle their finances without the full-time salary expense.

2. Is a Comptroller necessary for my HVAC or plumbing business?

No, unless your business works with government contracts or is structured as a nonprofit.

3. What’s the difference between a Controller and a CFO?

A Controller focuses on financial reporting and management, while a Chief Financial Officer (CFO) is responsible for strategic financial planning and growth initiatives. Many businesses hire a Controller before bringing on a CFO.

4. What qualifications should I look for in a Controller?

Look for candidates with:

- A CPA (Certified Public Accountant) or CMA (Certified Management Accountant)

- Experience with QuickBooks, Xero, or industry-specific accounting software

- 5+ years of experience in financial management

5. How do I transition from a bookkeeper to a Controller?

If your business has outgrown basic bookkeeping, start by hiring a Controller or an outsourced accounting firm to help with financial strategy and reporting.

Final Thoughts

For home service business owners, choosing the right financial expert can make a big difference in profitability and efficiency. While a Controller is the best choice for financial oversight in private businesses, a Comptroller is only relevant for public sector organizations.

By understanding the differences between a Controller vs. Comptroller, you can make a more informed decision about your business’s financial future.

If you’re looking to scale your home service business, investing in the right financial management professional can improve cash flow, ensure compliance, and drive profitability.

Need financial guidance?

Consider hiring a fractional Controller to streamline your finances without the cost of a full-time hire.